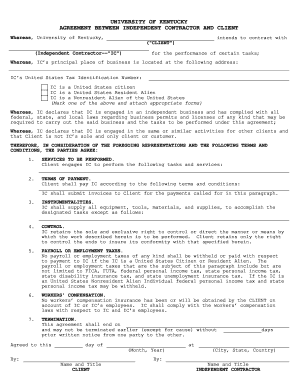

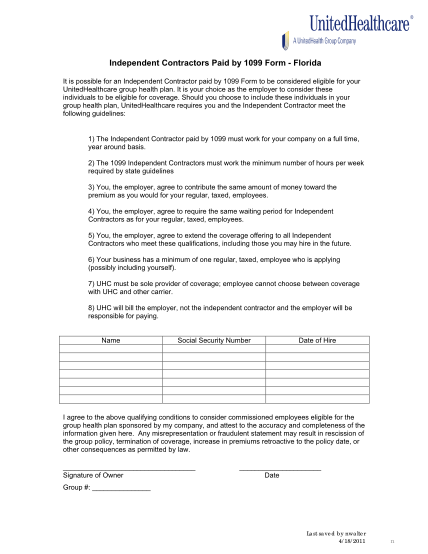

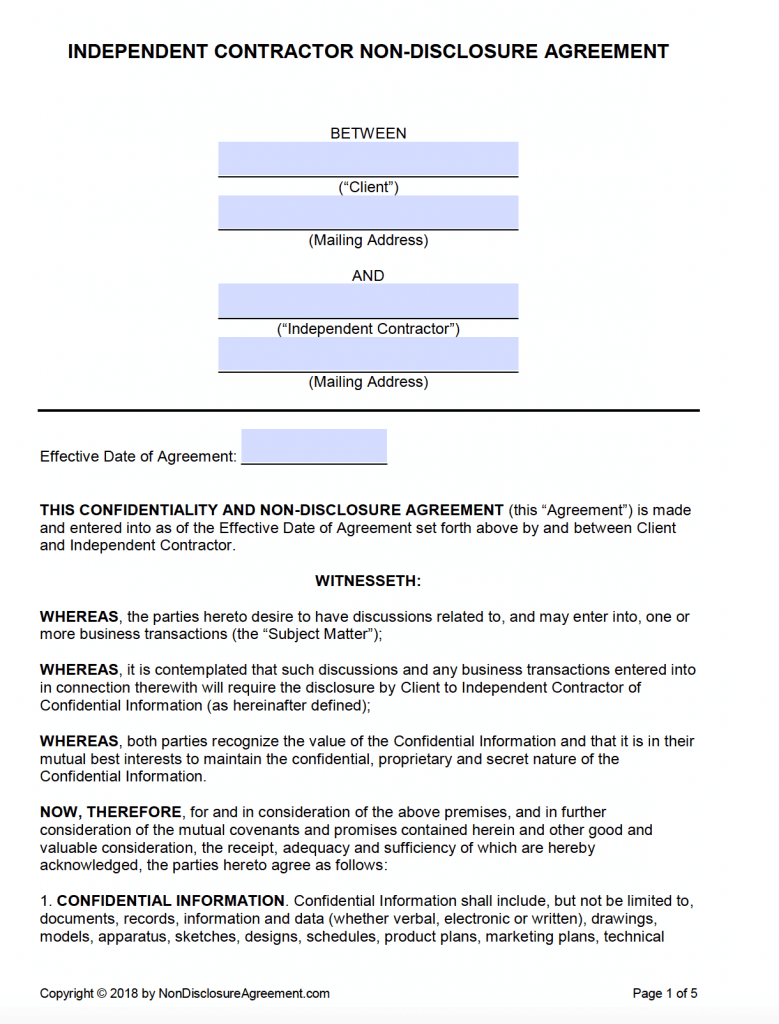

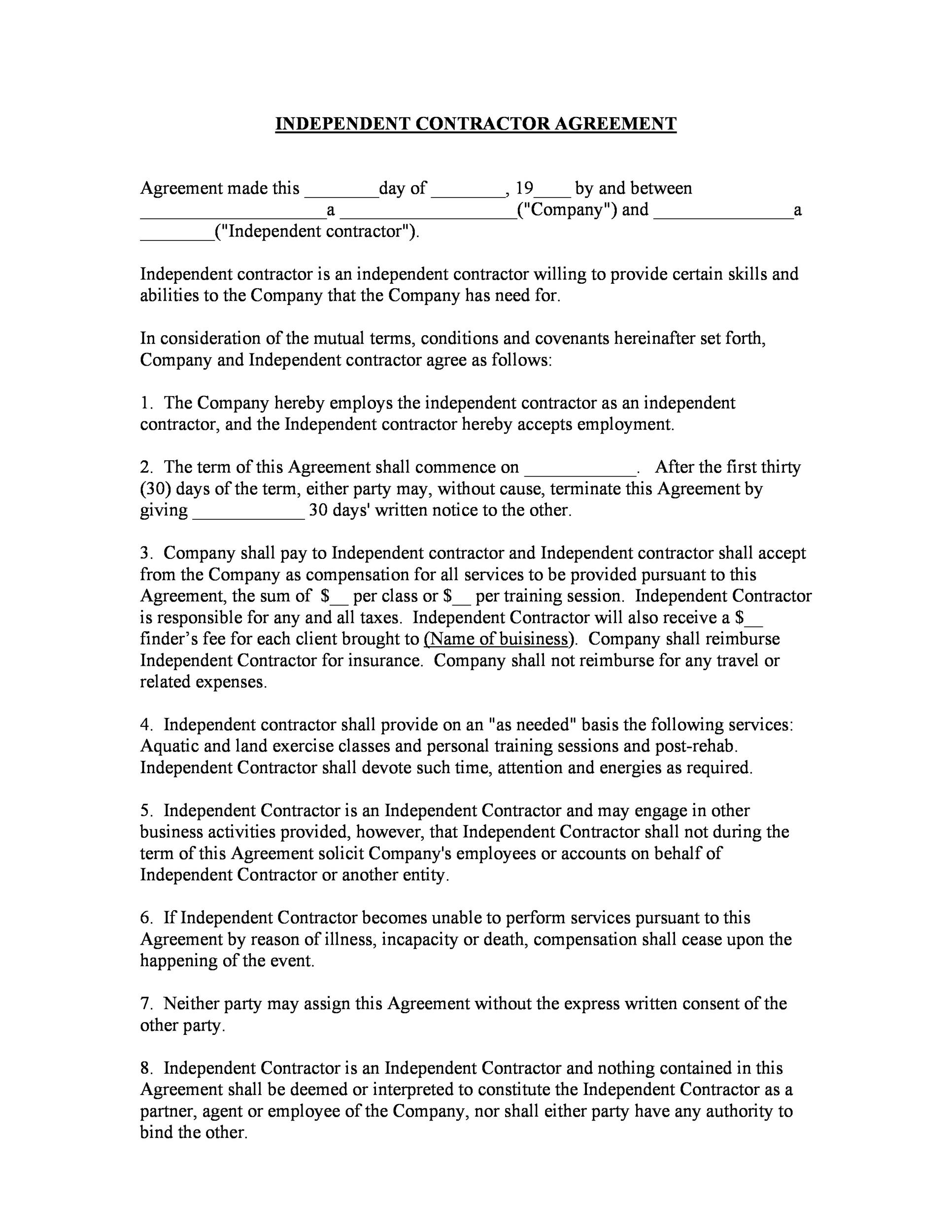

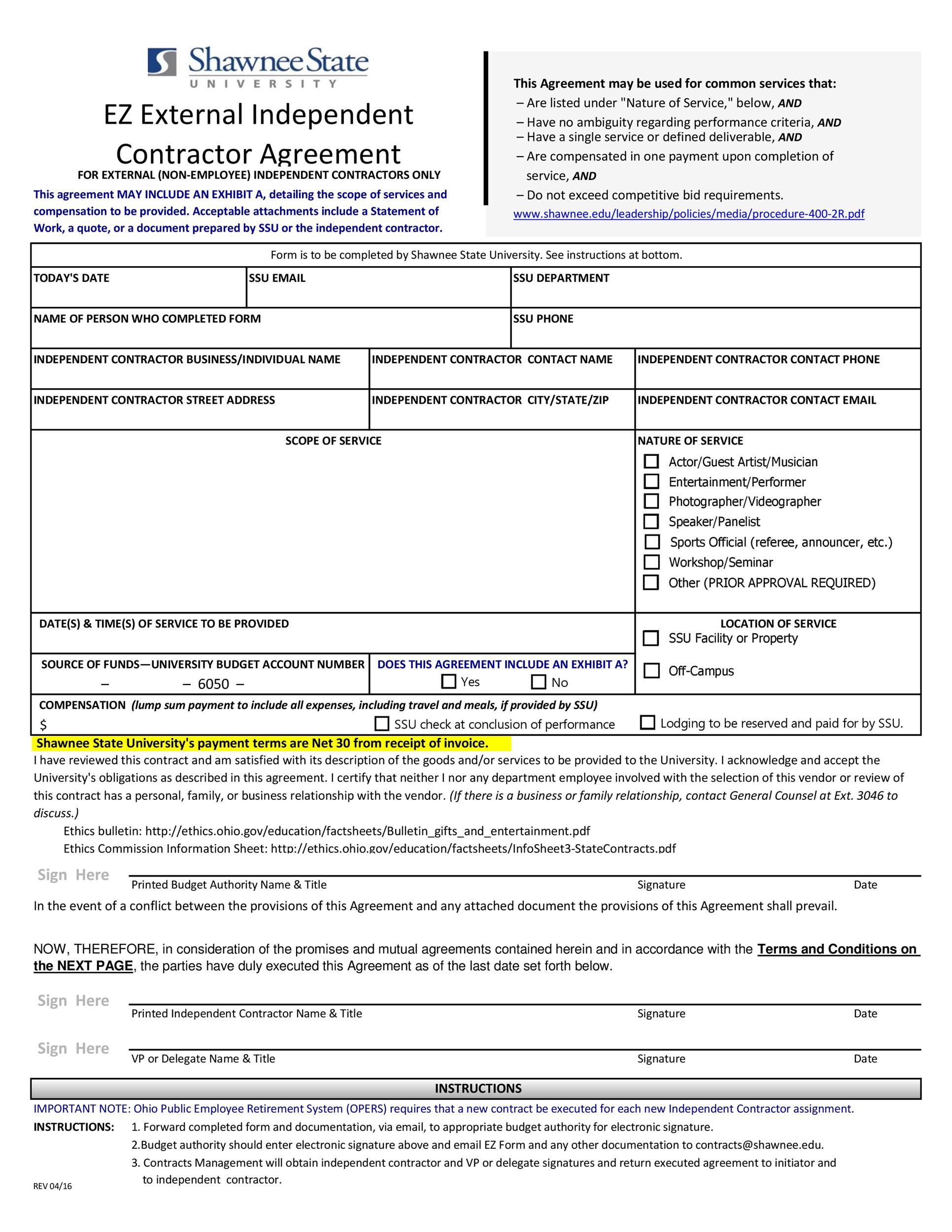

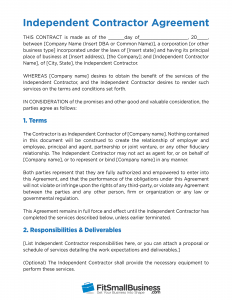

In addition to holding both parties accountable, the contract protects the client from certain liabilities by clarifying the contractor's independent status Independent contractors are responsible for ensuring that they and their subcontractors operate within State law, pay their income tax, and obtain necessary insurance coverageThe taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties for payer's who file the information returns late As an independent contractor, you should file your tax return timely You should include the income informationIndependent Contractor Attestation It is possible for an Independent Contractor paid by 1099 Form to be considered eligible for your UnitedHealthcare group health plan It is your choice as the employer to consider these individuals to be eligible for coverage Should you choose to include

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

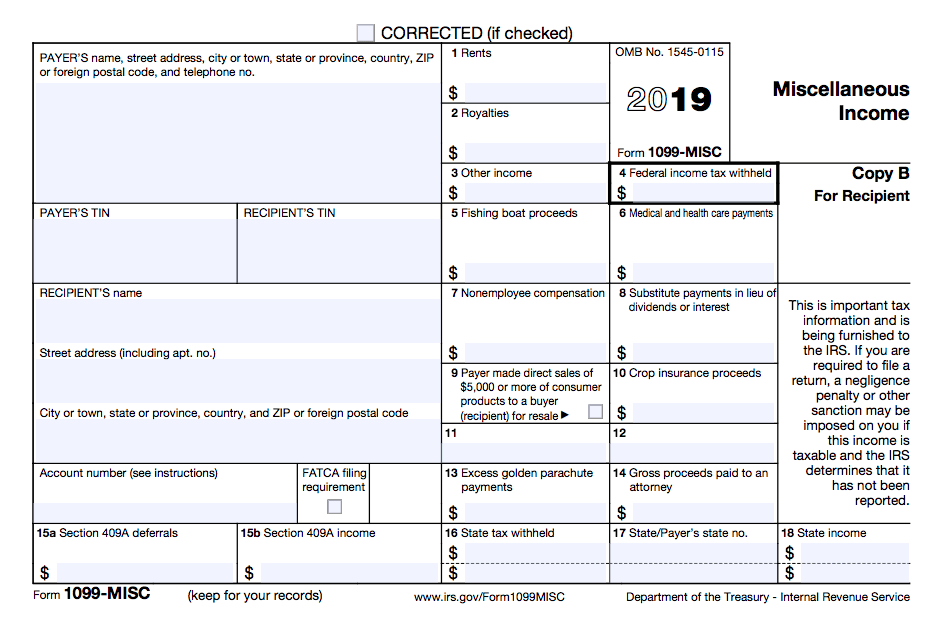

1099 form independent contractor 2019 pdf

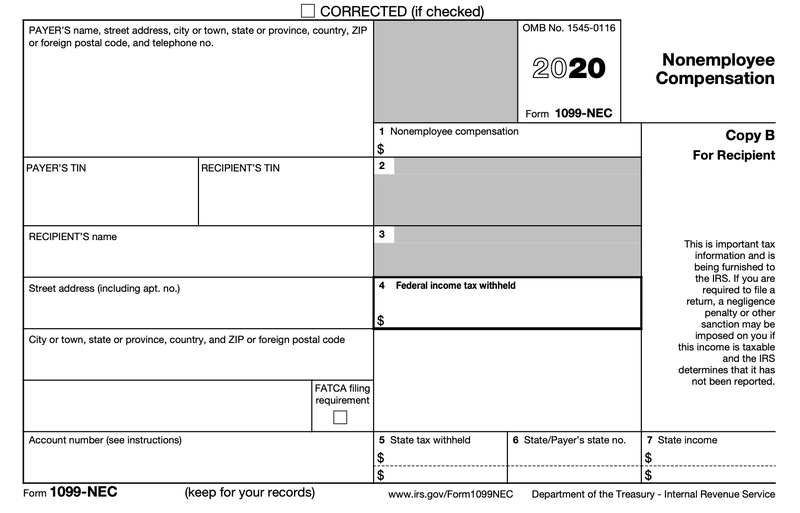

1099 form independent contractor 2019 pdf-Here, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application process 1099NEC is the version of Form 1099 you use to tell the Internal Revenue Service whenever you've paid an independent contractor (or other selfemployed person) $600 or more in compensation (That's $600 or more over the course of the entire year)

1099 Form Independent Contractor Free

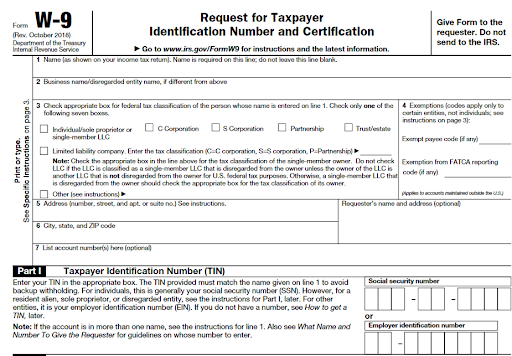

If you are classified as an "independent contractor," you may be paid with a "1099" with no deductions made for taxes, unemployment, or other contributions that an employee pays Your terms of employment may have been decided by an agreement or contract, even if it is just verbal, or perhaps you have not even discussed the terms of your employment with your employer An independent contractor fills out a W9 for their client For a sole proprietor, these 1099 forms (along with all the business expenses) flow onto Schedule C and then on to the 1040 For a partner, these 1099 forms flow onto Schedule K of a partnership return The partnership issues the partner a Schedule K1 which then flows onto the 1040Employees or Independent Contractor Use different forms 1099, W9, W4, W2 Oh my!

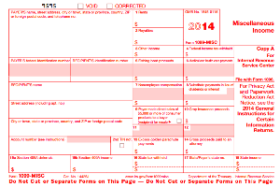

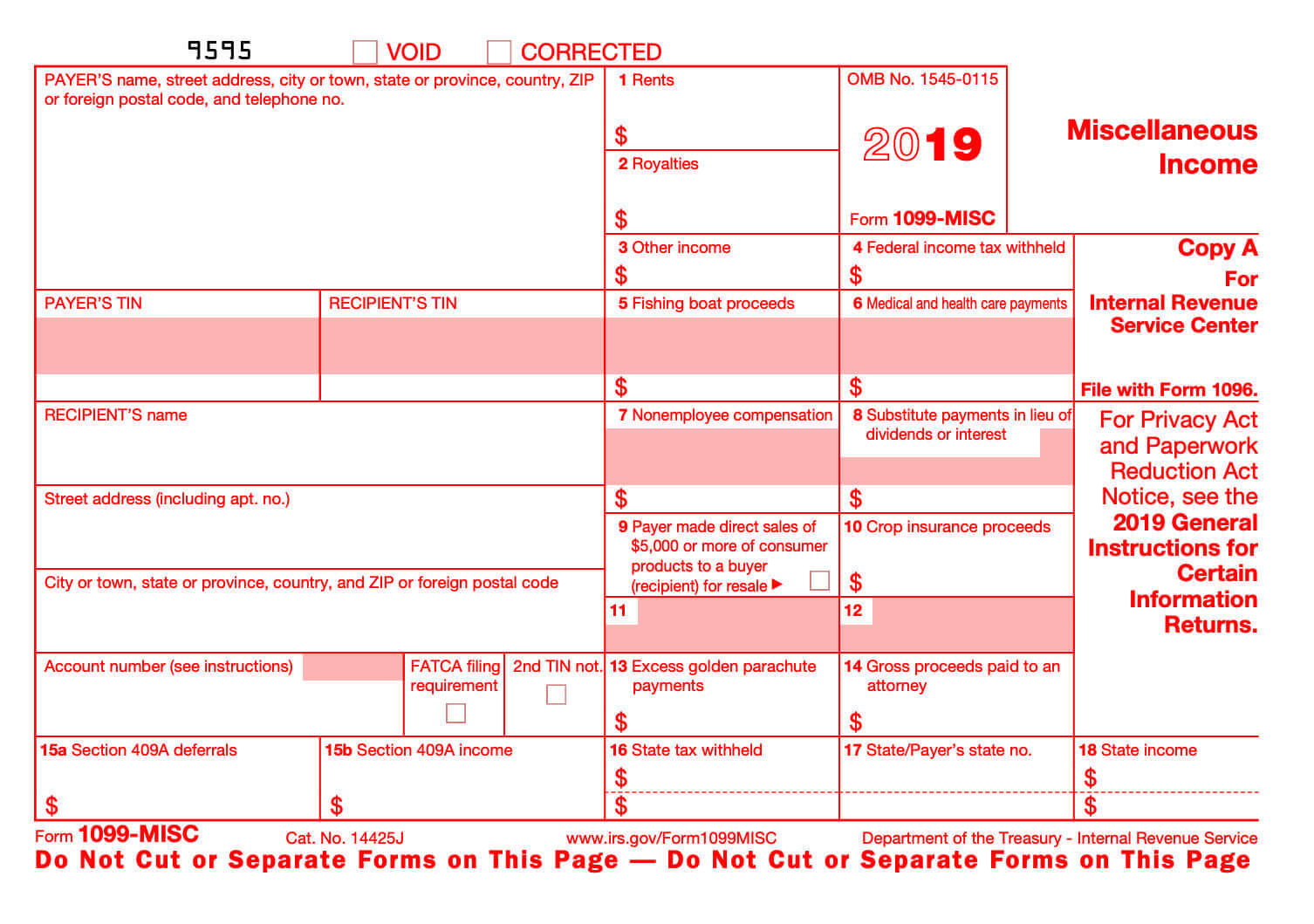

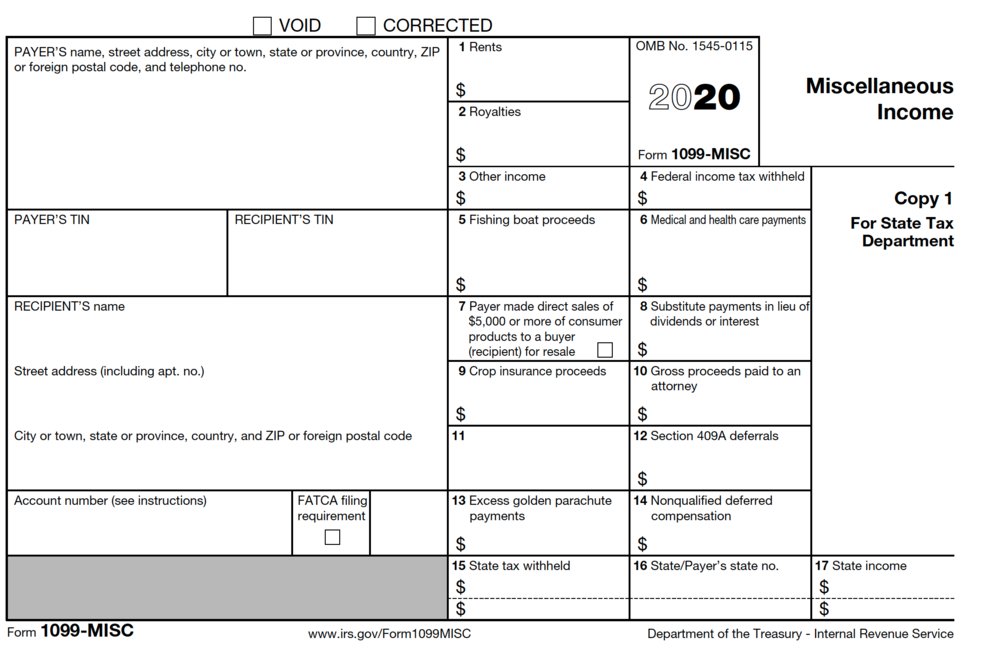

Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC) The IRS 1099MISC form could be the single most important – and annoying – piece of paper you'll have to deal with this year Payments totaling $600 or more to an independent contractor or landlord during the year, for such items as compensation for nonemployees or rent, require that you provide the recipient with a 1099MISC form Don't sweat getting a form 1099MISC Here we will do a dive deep into tax deductions other than your typical office supplies To shed some light and make itemizations a little less "taxing," Keeper Tax has compiled a quick summary of deductions you might qualify for, and should be sure to take, in order to minimize your costs and maximize your success on your tax

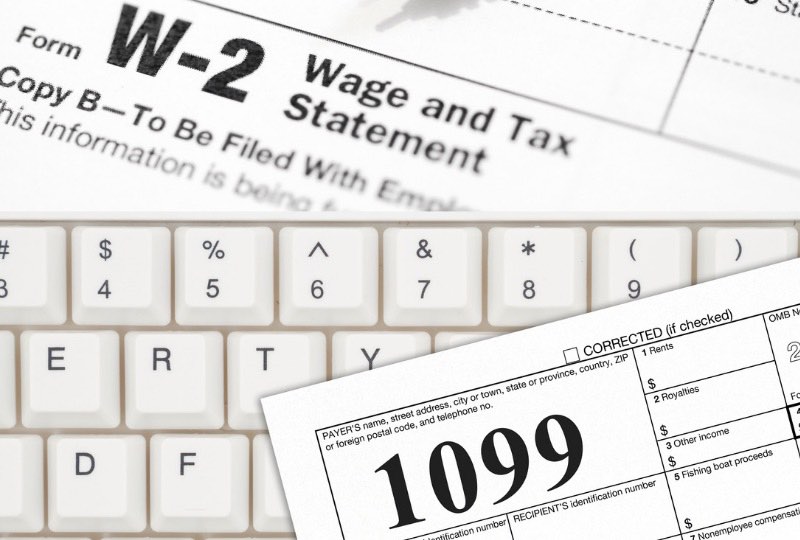

Businesses prepare different forms for employees and independent contractors for tax purposes For an employee, the employer is supposed to offer a complete copy of IRS Form W2 For an independent contractor, the employer is supposed to provide a duly filled copy of IRS Form 1099CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the other 60 Subcontractors, Independent Contractors and Affiliates 61 Subcontractors 62 Prime Contractor and Subcontractor Obligations 63 Independent Contractors and SelfEmployed Individuals 64 Subsidiaries and Affiliates 70 Mergers and Acquisitions 80 Enrollment Instructions for Contractors not yet enrolled in EVerify

Who Are Independent Contractors And How Can I Get 1099s For Free

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer Whether it's cash dividends paid by a company that owns a stock or interest accrued from a bank account, a taxfree 1099 can be issued 1099 Form IndependentEFile a 1099 form with IRS 1099 Forms Supported 1099NEC, 1099MISC, 1099A, 1099div, 1099INT, 1099K and 1099R Trusted by 95,000 Businesses Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

1099 Forms Everything Businesses Contractors Must Know To Be Stress Free About Taxes

1099 Independent Contractor vs Employee Updated If, after reviewing the three categories of evidence, it is still unclear whether a worker is an employee or an independent contractor, Form SS8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding (PDF) can be filed with the IRS The form 1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes However, you can avoid 1099 contractor status if you formed a corporation for your business The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment tax The Form 1099 NEC is an exclusive form that business taxpayers will use to report all payments made to independent contractors or selfemployed professionals, starting from , the tax year This shows that Form 1099 NEC replaces 'Box 7' on Form 1099 MISC, which was where clients previously used to report payment for every nonemployee

Ready For The 1099 Nec

Issue Form 1099 Misc To Independent Contractors By 1 31 14 Kirsch Cpa Group Accounting Tax

You will get a 1099 form in the mail if you received certain types of income or payments (other than wages, salaries, or tips) during the year Generally, you will have to report the information from a 1099 on your tax return We have divided the topic of 1099 forms into three pages Use a 1099 spreadsheet template (Excel or google sheets) Perhaps the best way to track your income and business expense as an independent contractor is through spreadsheets Furthermore, it is beneficial while filling out 1099misc forms Open either Excel or Google Sheets to begin the expense tracking process January 31st is usually the due date that your company needs to have sent the 1099 form to its recipient For edelivery, a company needs to have delivered the email to the recipient informing them that their form is ready Zenefits offers the option to prepare and store the 1099MISC for independent contractors

What Is The Difference Between A W 2 And 1099 Aps Payroll

Free Texas Independent Contractor Agreement Pdf Word

Employees and Independent Contractors have completely different forms to submit In a previous post, we talked about the differences between an employee and independent contractor Now, let's talk about the forms 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form that lists your income and all the deductions that were withheld from your pay throughout the year, including federal, state, Social Security and Medicare taxesHow to fill out 1099MISC Form Independent Contractor Work Instructions Example Explained Write Quickly and Confidently Grammarly

Independent Contractor 101 Bastian Accounting For Photographers

What Is A 1099 Form And How Does It Work Ramseysolutions Com

561 1099 independent contractor Jobs 50 Transcynd Claim Partners Independent Contractor Assignments (1099) Outside Field AdjusterNationwide CAT/Daily Clearwater, FL $37K $68K (Glassdoor est) Easy Apply 19d Transcynd Claim Partners is a rapidly growing Independent Adjusting & Third Party Administration This page is about PPP loans for 1099 independent contractors For more information on PPP loans generally go here Update (1/11/21) As of , PPP applications are open again If you're a sole proprietor (1099) and are interested in beginning your application process, start hereDoes the 1099 form prove independent contractor status?

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

W 9 Vs 1099 Understanding The Difference

Covered under a selfelected workers' compensation insurance policy or obtain an Independent Contractor Exemption Certificate (ICEC) How to obtain an ICEC Read, complete, and submit the entire original and notarized application and waiver form withForm 1099 is a type of information return; A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company

1099 Form Independent Contractor Free

Form 1099 Nec Instructions And Tax Reporting Guide

Starting in the tax year , companies working with contractors use Form 1099NEC to file contractor payments instead of Form 1099MISC, which was used in previous years Effectively for the tax year , what used to be Box 7 on the Form 1099MISC becomes Box 1 on the Form 1099NEC, and Box 7 on the 1099MISC will be removedIndependent Contractor Policy IC Form Instructions The IC Form must be completed and submitted to the UA Tax Office prior to an individual performing any services for which a fee payment is expected, including guest speakers (The IC Form is not required when paying "expense reimbursement only") Upon receipt of a completed IC Form, theA 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service ( IRS ), and it relieves the employer from the responsibility of withholding taxes from the individual's paychecks

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

The most important document you will need to hire freelancers and independent contractors is an Independent Contractor Agreement This outlines the terms of a deal between a client and contractor and makes the agreed terms legally binding It will also be necessary to have an IRS form W9 available when you begin the process of hiring a contractorDepending on your niche' and the 1099 Contractor's status with the IRS, you might decide to hire a 1099 Contractor to work with your employer clients based on specific contracts Either way, when you find a 1099 Contractor that you like and want to work with, there is still an onboarding process that needs to take place The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

What Tax Forms Do I Need For An Independent Contractor Legal Io

It's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter1099 Form is the tax form that the business individuals will use to report compensations paid to independent contractors When you earn income through the below payments, the you receive a 1099 Form $600 or more compensation as prize for services performed as nonemployee Rent, or rewards of $600 or more in a calendar year as miscellaneous If you are selfemployed, you can start with Form 1040ES (Estimated Tax for Individuals), and then file the other necessary forms with your 1040 Form during the tax season If you need help with a 1099 contractor needing a business license, you can post your job on UpCounsel's marketplace UpCounsel accepts only the top 5 percent of lawyers to

Irs Form 1099 Reporting For Small Business Owners In

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

You must provide Form 1099NEC to your contractors each year Understanding Form 1099NEC A company must provide a 1099NEC to each contractor who is paid $600 or more in a calendar year Independent contractors must include all payments on a tax return, including payments that total less than $600 While the income of workers is reported on Form W2 by their employer, independent contractors will collect Forms 1099MISC to report income to the IRS It is a common exchange between independent contractors and their customers To allow this to happen in the first place, the independent contractor must submit a Form W9 so that Read More »An independent contractor receives this form (1099NEC) instead of the From W2 form when the payer doesn't consider you an employee, and therefore doesn't withhold any of the usual payroll taxes An exception to this is Box 4 on the 1099NEC form Namely, if you do not provide a TIN to the payer, they must backup withhold on certain payments

Know Which Irs Form To Use If You Paid Independent Contractors Small Business Trends

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

Form 1099MISC is the most common type of 1099 form 1099MISC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly employed by the business entity or individual making the payment For example contractors It can also be used to report royalties, prizes, and award winningsNo Simply providing a 1099MISC form to the IRS and the individual isn't proof that the individual is an independent contractor The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To Prepare Form 1099 Nec When You Employ Independent Contractors Quickbooks

Independent Contractor Income Independent contractor income is compensation you receive for doing work or providing services as a selfemployed individual, not as an employee If you are selfemployed and an independent contractor, your compensation is reported on one of the many 1099 Forms (along with rents, royalties, and other types of income)Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

Managing The Ubiquitous Form 1099 Payroll Management Inc

1099 Misc Instructions And How To File Square

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

How To Fill Out A 1099 Misc Form

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor 101 Bastian Accounting For Photographers

Send Form 1099 To Independent Contractors By January 31st

1099 Form Independent Contractor Free

What S The Difference Between W 2 1099 And Corp To Corp Workers

How To File 1099 Misc For Independent Contractor Checkmark Blog

Free Independent Contractor Agreement Templates Pdf Word Eforms

Form 1099 Nec Form Pros

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec

What Is The Account Number On A 1099 Misc Form Workful

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

A 21 Guide To Taxes For Independent Contractors The Blueprint

What Is Form 1099 Nec

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

An Employer S Guide To Filing Form 1099 Nec The Blueprint

A 21 Guide To Taxes For Independent Contractors The Blueprint

Form 1099 Nec For Nonemployee Compensation H R Block

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

1099 Misc Form Fillable Printable Download Free Instructions

Independent Contractors Archives Taxgirl

What To Know And Where To Go Regarding 1099 Filings Maryland Nonprofits

What Is The 1099 Form For Small Businesses A Quick Guide

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Irs Changes Reporting Of Independent Contractor Payments Uhy

Instant Form 1099 Generator Create 1099 Easily Form Pros

What Is A 1099 Contractor With Pictures

Independent Contractor 101 Bastian Accounting For Photographers

An Employer S Guide To Filing Form 1099 Nec The Blueprint

50 Free Independent Contractor Agreement Forms Templates

1099 Misc Form Fillable Printable Download Free Instructions

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Where Is My 1099 Atbs

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

50 Free Independent Contractor Agreement Forms Templates

1099 Misc Form Fillable Printable Download Free Instructions

New 1099 Nec Form For Independent Contractors The Dancing Accountant

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

What Is 1099 Misc Form How To File It Complete Guide

Freelancers Meet The New Form 1099 Nec

Create An Independent Contractor Agreement Download Print Pdf Word

Independent Contractor Agreement Template Free Pdf Sample Formswift

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

New Irs Rules For 1099 Independent Contractors

Your Ultimate Guide To 1099s

W 2 Employees Vs 1099 Contractors Due

What Are Irs 1099 Forms

1

Free Independent Contractor Agreement Free To Print Save Download

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

50 Free Independent Contractor Agreement Forms Templates

3 Tips For Payroll Tax Filing Form 1099 Misc Novato Ca Patch

Free Independent Contractor Agreement Templates Pdf Word Eforms

How To File 1099 Misc For Independent Contractor Checkmark Blog

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Form Independent Contractor Free

3

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

1

What Are Irs 1099 Forms

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Free Independent Contractor Agreement Template What To Avoid

Free Independent Contractor Agreement Pdf Word

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Form 1099 Nec Instructions And Tax Reporting Guide

New Jersey Continues Its Push To End The Misclassification Of Employees As Independent Contractors Morea Law Llc An Employment Law Boutique

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

1099 Form Independent Contractor Free

0 件のコメント:

コメントを投稿